Insight for Every Decision.

Confidence in Every Move.

Backed by research, guided by strategy, and driven by creativity to elevate investor relations, empower boards and management, and exceed investment community expectations.

Trusted by

'Good enough' isn't good enough

Over the last 30 years, this mindset has fueled Rivel's commitment to providing companies with actionable insights and advisory solutions that elevate performance and support informed decision-making.

Our clients trust us not just because we meet the standard—but because we set it.

- Investor Relations Solutions

- Governance and Sustainability

- Design and Copywriting

- Banking Research

Strategic Support for

Investor Relations Professionals

TrendLignInvestor Perception Studies

Gain clear insights into how investors view your strategy, leadership and story so you can align internally and avoid costly surprises.

GuideLignIR Best Practices and Advisory

Access a trusted network of IR peers to help you navigate evolving investor expectations and strengthen your IR program.

StoryLignInvestor Communications and Investor Days

Deliver a clear, compelling message that builds trust, establishes credibility and keeps investors aligned with your strategy.

Solutions for the Leaders Shaping Governance and Sustainability

Sustainability and ESG Consulting

Full-service sustainability consulting and ESG support, including strategy development, risk assessment, gap analysis, regulatory compliance guidance and more.

Corporate Governance Advisory

From year-round governance strategy and advisory to investment community and corporate benchmarking insights.

Board Evaluation

Clear, actionable insights for board performance improvement.

Elevate Your Materials with Expert Design and Copywriting

Investor Presentations

Messaging and design that enhance clarity, strengthen credibility and reinforce your strategy.

Sustainability Reporting

Compliance-focused content aligned with evolving regulatory standards.

Custom Creative Support

Guidance on branding, storytelling and visual impact.

Unlock Local Insights to Drive Actionable Strategies

The Prospect Report

What percentage of prospects (non-customers) are aware of your financial institution, and how many would consider using your financial institution in the future?

The Customer Report

See how each financial institution in your trade area is rated by its own customers on customer service, technology and policy metrics. How does your financial institution compare to your local competitors?

Your Custom Strategic Solution

Tailored solutions for financial institutions, including digital and in-person focus groups, environmental competitor scans, employee assessments, and more!

Rivel provides great tools and insight for IROs and the C-suite, whether it's their high-quality perception studies or benchmarking data. I've found the team to be an objective and trusted resource.

Upcoming Rivel Events

NEXT: Investor Perception Research: Rivel’s Non-Negotiables. — April 1, 2026

This webinar examines the gap between frequent feedback and accurate insight, exploring how teams may overweight vocal investors, mistake repetition for consensus, or assume clarity where uncertainty remains. We’ll discuss how to recognize these pitfalls and strengthen the quality of perception signals that guide IR decision‑making.

In-House Creative Studio

Transform reports, decks, and presentations into compelling, design-driven tools that captivate stakeholders, clarify your strategy and elevate your brand.

Are Boards Fulfilling Their Fiduciary Duty When It Comes to AI Oversight?

Board Oversight of Responsible AI

Explore what we have researched (PDF download) →

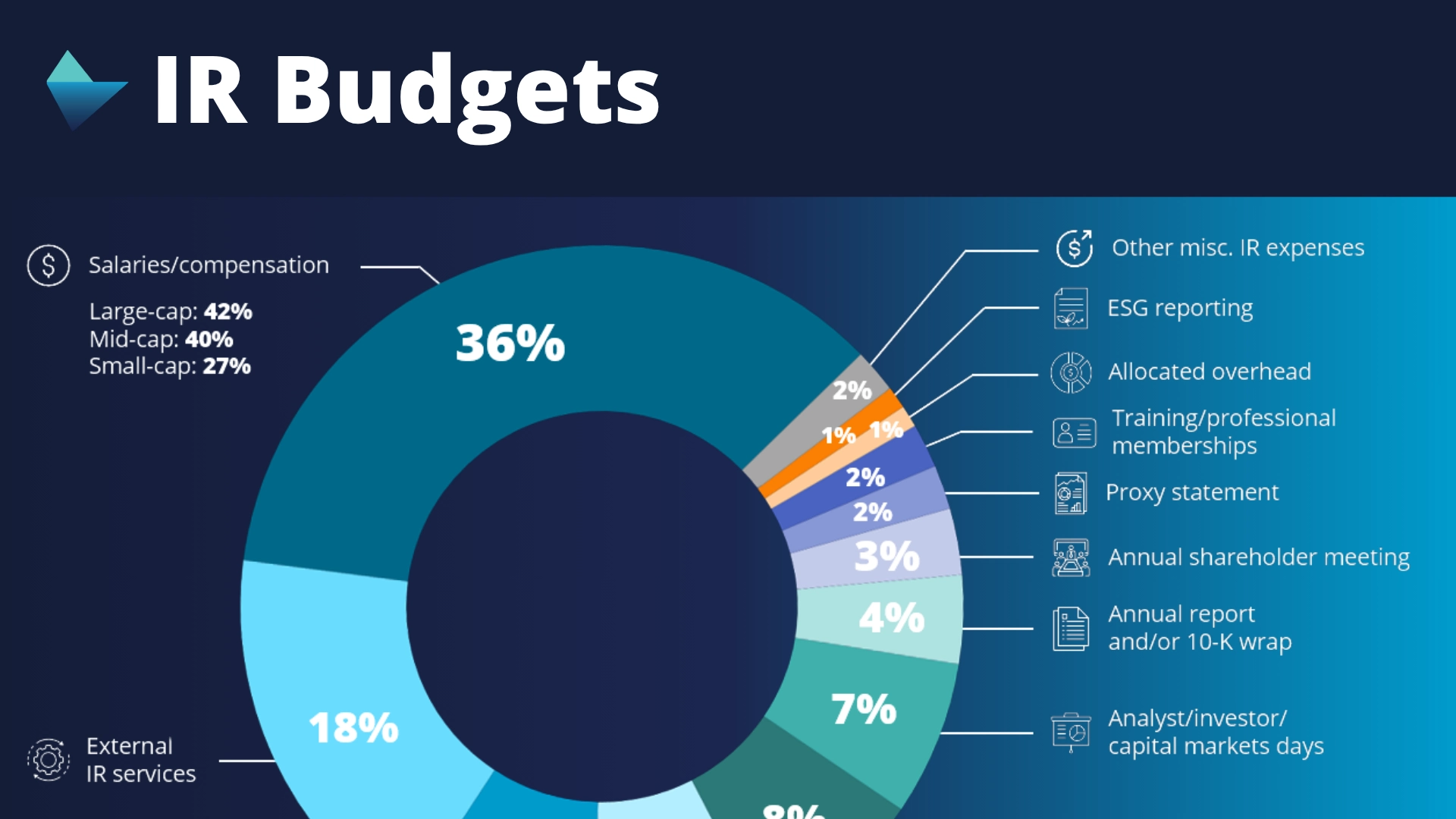

How does your IR budget stack up to other companies?

Global Investor Relations Budget Allocation

See benchmark data (PDF download) →