Work with Rivel Banking Research for proven insights, trusted by The Financial Brand and Bank Director®.

The Prospect Report

Prospect Reports are customized to the geographic trade area for each Retail or Commercial client to show:

- What percentage of prospects (non-customers) are aware of your financial institution.

- How many would consider using your financial institution in the future.

- The effectiveness of your marketing in driving a brand image of Strong Reputation, Community Contribution, Technology, Customer Service, etc.

Perception and opportunity research is updated twice per year to allow financial institutions to track trending data over time.

The Customer Report

Customer (or Member) Reports are individualized specifically for each Retail or Commercial client to show:

- How each financial institution in your trade area is rated by its own customers on customer service, technology and policy metrics.

- How your financial institution's scores compare to your local competitors.

The data reveals:

- What percentage of your current customer base is loyal.

- What percentage is vulnerable to leaving and why.

Customer experience benchmarks are refreshed twice a year to provide financial institutions with updated retention metrics.

Your Custom Strategic Solution

Rivel delivers tailored solutions to address your institution's unique challenges. Our team of expert analysts conducts custom studies aligned with your goals and timelines. To provide actionable insights, we offer in-depth research additions such as:

- Digital and in-person focus groups.

- Environmental competitor scans.

- Employee alignment and engagement assessments.

Whether you aim to enhance customer experiences, expand into new markets, or identify opportunities beyond consumers, Rivel partners with you to understand and address your institution's critical needs.

-

Banks use these customer reports to:

Monitor customers’ experience every 6 months

Ensure loyalty and reduce attrition

Increase cross-sales

Obtain objective competitor insight

Deep dive on strategic initiatives

-

Banks use these prospect reports to:

Track brand awareness to increase market share

Stand out from local competitors

Draw in target customers

Create effective messaging

Maximize marketing investment

Banks use these customer reports to:

- Monitor customers’ experience every 6 months

- Ensure loyalty and reduce attrition

- Increase cross-sales

- Obtain objective competitor insight

- Deep dive on strategic initiatives

Banks use these prospect reports to:

- Track brand awareness to increase market share

- Stand out from local competitors

- Draw in target customers

- Create effective messaging

- Maximize marketing investment

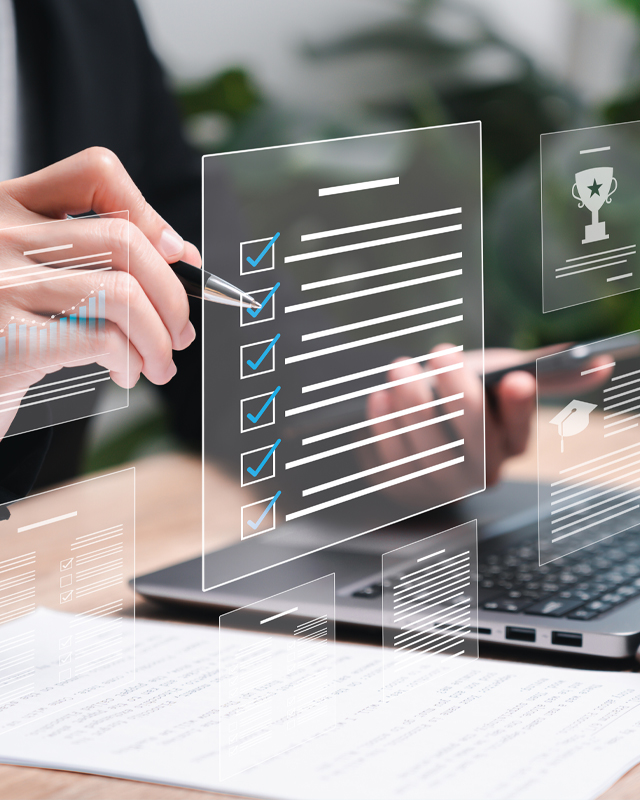

Request Personalized Insights on Your Financial Institution

*National and custom data available for blue states